This is a Saving Ninja savings report. Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet. Please note that I split my expenses equally with my partner and the savings rate, house equity and house value represent my share only. The spreadsheet calculates my savings rate based off £12,000 worth of expenses per year, even though my expenses are actually Less Than 10k Per Year . This is to create a buffer; I’m aiming for at least 12k to reach financial independence.

Oooo, look at that nice big 90!

Investments took a bit of a nose dive this month and lost £1,579 in value, although that was expected with the huge £2,816 gain from last month .

BUT, we still saw my net worth grow by £3,337.

This increase came from one extra special new investment to my portfolio: a buy to let property!

Spurred on by Nick and his latest property purchase . I thought it was about time I added something into that forever blank ‘Other Investments’ section.

For my BTL purchase, I used a very cool new platform called Property Partner . They let you invest as little as £100 into a huge variety of properties that they manage and I’ve heard nothing but good things from the friends who use them.

So, I decided to stick £1k in first to test out the platform. Say hello to property #1:

The property consists of 9 flats in the up and coming area of Cheshire (near where I grew up) and I now own 2000 shares in it, woo woo!

Click here to view the listing.

The expected dividend yield is a pretty good 4.21% but all of these dividends will be automatically reinvested back into the property (at a discount) and I’ll be hoping for a decent capital gains pay off. As it’s risen 26.5% in the last 5 years, and some properties in the UK have risen by over 50%, it’s an investment risk that I’m willing to take.

I know what you’re going to tell me: The property market can’t go up forever! I understand your concerns, BUT, I’m only investing £1k for now, and I’m thinking that even if there was a small property crash, the dividend income alone may even outperform the stock market. You’ve got to have a little fun, right?

I actually paid a premium of 7.8% to purchase this property due to the current popularity, who wouldn’t want it - it’s pretty flipping cool - which is why my ‘Other Investments’ section only stands at £911 after £1000 invested. Let’s see how long it takes for me to break even!

If you want to purchase a share in the same property and become my fellow investor, check it out here and let me know in the comments below!

Be sure to understand the risks of P2P lending before you buy anything.

Other Thoughts

May has been a month full of walking and wedding planning. The wedding is under 2 months away now and I’m getting pretty damn nervous.

Thankfully the planning seems to all be falling into place, although it’s still probably going to be a mad rush in the weeks leading up to it (no matter how organised I think I am!)

That reminds me, there is probably going to be a period of no posts for about a month in August due to the wedding and honeymoon. I was hoping to get some written and scheduled to bide you guys over, but I seem to be running out of time. We’ll see, still some time left yet :)

Matched Betting

Even though I said last month that I was going to ’taper-down’ the EW betting . I actually… kinda didn’t.

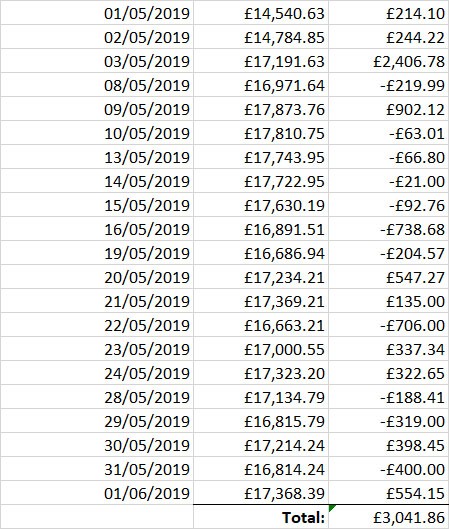

I made an additional £3,041 this month from matched betting (mostly EW). I guess I’m addicted to the tax-free money!

Saying that, most of the month was pretty rubbish. The bulk of my profit came from an insane profit winning day on the 3rd of May.

I said I was going to quit, but the profit is too good! Over 2k made today! https://t.co/KMoW1FGTLL pic.twitter.com/8c8YFTjCyl

— SavingNinja (@SavingNinja) 3 May 2019

I will be lowering my stakes to £20 EW (from £40 EW) for the time being and trying out a new risk-free method called ‘arbing’ this month. Let’s see how it goes!

How was your month?