Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

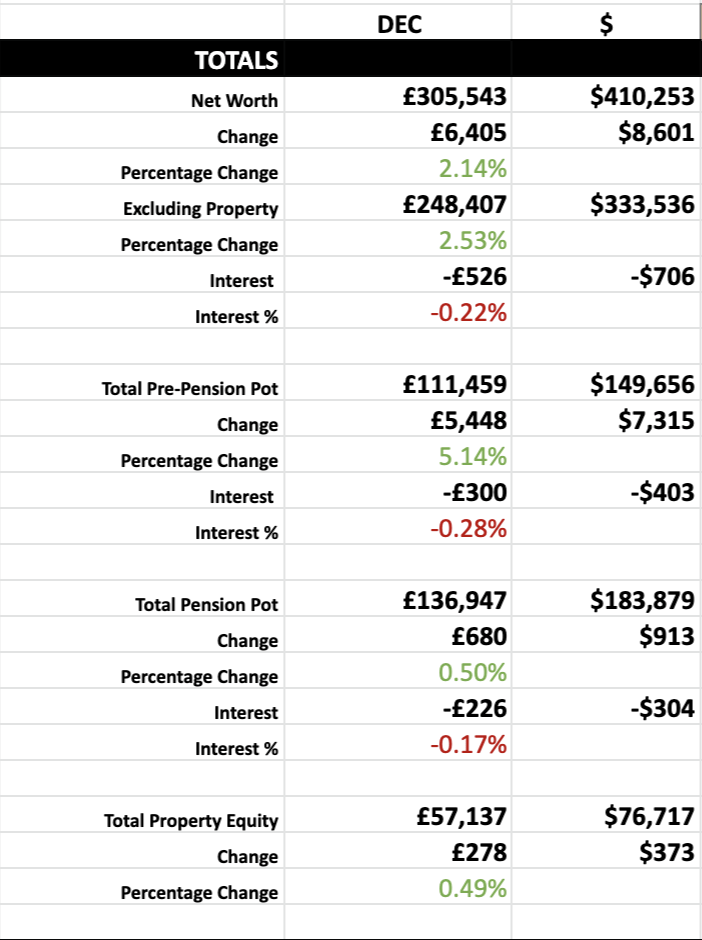

I’ve made it to my initial financial independence goal of £300k net worth! This has taken me around 4 years of saving, with the last 42 months being tracked on this blog . This should, on paper, cover my current expenses indefinitely, although the sequence of returns risk would be huge due to having a lot of my net worth locked away in my pension.

I’d need to make sure that my pension bridge didn’t run out before I could access my pension. I would, however, be really comfortable ‘barista FIRE’ing’ and working / earning some income from my hobbies such as writing . It’s a nice feeling to think that if anything ever happened to my main job, or if I became burnt out, I’d be able to support myself switching to a part-time, or hobby-style employment - which is what a lot of young FIRE seekers are trying to achieve!

I’m in the fortunate position that I love my job. So this ’lean-FI’ figure is just the beginning. I need to double this to have enough for Mrs SavingNinja to FIRE too, more than that is then needed to account for us potentially increasing our spending above £12k. I think £1m is a nice goal for our family.

£1m according to my calculators with my current savings rate would take another 10 years, ouch. I’d like to start trying to transition into a post-FIRE life sooner instead of deferring until a figure is reached, this should be doable now that I’m working remotely. We just need to decide which country we want to settle in!

Trying to decide what our post-FIRE life will be, and starting to live it, is a better goal than a monetary one now that I’ve reached a considerable amount invested. At least now I won’t be worried about my family missing out on any huge gains - just like the 16% gains from this year! I’m super glad that I invested aggressively pre-COVID as it meant that this year alone the interested earned has been around £33k. Without this growth, I wouldn’t have reached this £300k target so quickly.

Back in the UK

It’s strange how memories work. Your strongest memories are what persist from your past, remembering only the extremes of a person or place. The passing of time corrodes your memories into a patchwork of these extremes.

This is the first time I’ve visited the UK since moving to Sweden in 2020. It seems that both myself and my wife have experienced this warping of memories during our visit. Our memories of what we missed from the UK were extremes, we were only remembering the good ones. In contrast, we didn’t realise what we love about Sweden until we came back to the UK. To name a few…

The rugged nature of where we live in Sweden simply can’t be found in the UK, the type of nature where in just 5 minutes of walking outside of our house, we can get on a kayak, paddle to an island and camp for a night in an idyllic spot by the water and light a fire in complete, unowned and untouched nature.

The fact that everyone is quiet on public transport and in general public places in Sweden. As we arrived at Manchester Airport, the first thing we were met by were the plethora of security cameras on the station, and then a loud racket as a cockle of chavs drunkenly made their way up one of the platforms with an office chair and kicking about a traffic cone. Then when we got on the train we could barely think as two northern ladies were talking and cackling behind us across the aisle of the train. This would never happen in Sweden, and we’ve got used to it.

A person always has to be on guard, analysing each thought to see if it is truthful or a misrepresented truth. This trip back to the UK will definitely mean that when I return to Sweden, my eyes will be a little more open.

Happy New Year!