Click here to see all of my past Savings Reports and view my interactive net worth chart

Go to How To Track Your Savings to check out the Saving Ninja Super Spreadsheet.

I’m now back in the market, phew!

During my second week in the US, I managed to open an Interactive Brokers account. I then proceeded to shift the bulk of our finances from our international accounts into Interactive Brokers. They flagged the transfer as ’large’ and it then took about a week to prove that I wasn’t money laundering.

It actually seemed to work out for the best as in the time that a large portion of our wealth was out of the market (a little over a month), there was a pretty big drop. And 2 days after I re-invested, there was a 4% gain in a single day!

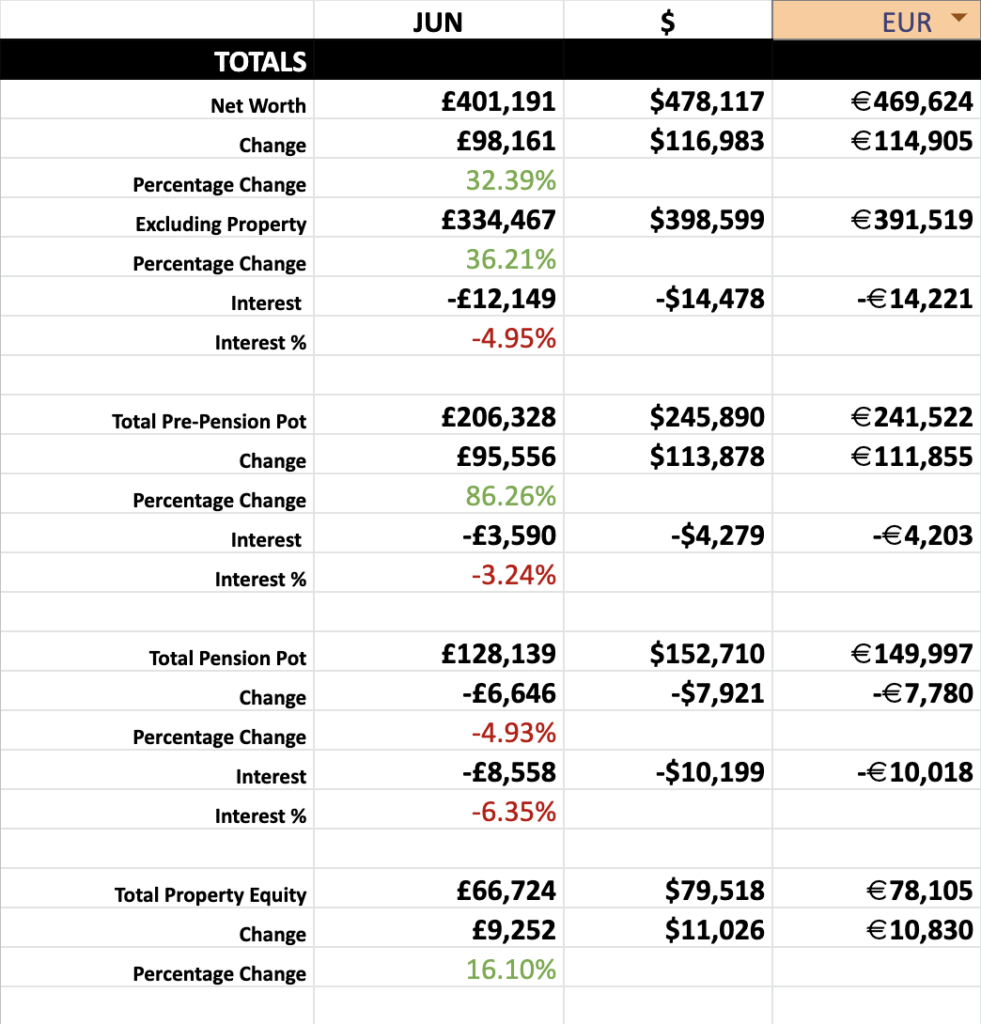

As you’ll see from the spreadsheet snapshot, the net worth figure has spiked by a lot. This isn’t just because of the accidental market timing, this month marks the time that Mrs SavingNinja and I have combined our investment pots.

We knew that we were going to have to do this at some point and now seemed like the perfect opportunity, here’s why:

My wife is without a job for the time being, and in the US, things are much more expensive so I have to pay for now. We made the decision as a family to move to a place where my salary would be much higher, but hers probably much lower. Teachers got paid a good amount in Sweden! We paid for our Swedish house deposit and car equally, but wanted to invest it together when we got the money back (more on this later). We won’t be FIRE’ing without each other anyway, so we may as well track the real goal! I still believe that keeping your finances separate is better for your relationship and financial goals. We still aim to do this if she gets a job that can pay for half of our expenses.

Around £50k of the increased net worth is from my wife. This came from a combination of her half of our UK house equity, and her half of our Swedish house equity. We sold our Swedish property and put all of that money into the stock market, and our UK home is still being rented out. This is why the Total Property Equity stayed more or less the same as my wife’s half of the UK house was added but all of our Swedish house equity got removed and added to the pre-pension pot of stock market investments.

This additional influx of cash from my wife as well as some extra from my relocation bonus and spare cash meant that we were able to add a hefty amount to our pre-pension investments. I sold all of my investments inside my Swedish tax-sheltered account (ISK) and English ISA, this amounted to around $127k, and, in turn, we bought $245k of investments; a $118k increase in the stock market.

The $245k was split, 90% VTI ETF, and 10% Alphabet stock.

After losing my Tesla stock when relocating to Sweden, I’ve become inclined to allocate a small fraction of our portfolio to ‘risky bets’ that I have a personal interest in. Alphabet is the new Tesla for me! It’s also the easiest way to own a little bit of SpaceX.

VTI is a broad index fund, although it is US-centric. I’m OK with this as I have UK exposure in my UK pension which is locked to a certain type of UK-weighted index fund, although I may consider diversifying our dollars a bit into another ETF when the investments grow.

This cash is also not in a US tax-sheltered account, as they don’t exist! But in the US, capital-gains tax is favorable and is between 0% and 15% depending on your taxable income when you sell.

Interactive Brokers and Margin Loans

Margin loans are a lot more popular in the US, and with Interactive Brokers, the interest rates are extremely low. I wanted to invest all of our cash from the Swedish house sale in these cheap markets instead of holding it for purchasing a house in the US (which we’ll try and do in 1 or 2 years when we qualify for a mortgage) and I’m confident that our portfolio is big enough to be able to borrow a fair amount on margin.

I intend to fund any bigger purchases like a car or an unknown expense via margin. As long as we don’t go above 20%, the risk of getting margin called is extremely low. This means we currently have around $50k available to us at a 20% margin. As we hope to have around $10k spare each month, the ability to pay this off relatively quickly also reassures me of its use.

The plan is to invest aggressively, and when the time comes, to fund the majority of our next house deposit via margin and then pay it off. Doing this means that we don’t have to keep a large portion of our wealth outside of the stock market for an unknown amount of time whilst we’re looking for a property.

This, of course, goes against all conventional wisdom of an emergency fund and house deposit, but I feel confident that if we don’t go above 20%, we’ll be good, and the risk is worth the reward! After we purchase our house, I think it will be best to always be 20% leveraged into the stock market. What do you think?

For context, historically Interactive Brokers offered margins as low as 1.2%. Right now, with the fed interest rate hike, they’re at 3%.

Settling Into the USA

There isn’t much to update you with here.

We’ve had a tremendous amount of trouble buying a car here. Not only are they extremely expensive and low in stock, but when we eventually bought one we couldn’t register it due to not having a US driver’s license. Over here in the States, you need to manually pay tax and get a physical license plate once you buy a car, they’re registered directly to you and not the car itself, so without registering it, it’s illegal to drive.

As we decided to live in a cheaper, more rural area, not having a car means that it’s basically like we’re in prison. We don’t even have a grocery store within walking distance, we’ve been stuck inside the house for a month now.

I’m hoping that this gets cleared up soon with a visit to the vehicle registration office (the RMV) on Friday. We have a car and insurance that’s not being used!

More on a comparison of the US to the UK and Sweden soon when we’ve been out and about a bit more :)

New SavingNinja Site

As I’ve been tweeting, I’m moving SavingNinja to a new platform: Hugo.

WordPress is ancient technology that’s on its way out. Hugo is a super-fast, Markdown-based, static site generator. I’m tired of having dodgy slow websites that crash all of the time, all wrapped in an unsecured WordPress shell. There is no need for this site to have a database or a server. Moving to a static site generator allows me to work in my preferred markdown environment, and have a super-secure, blazing fast website that is free. I can even work in Git and improve the website safely in separate branches (doing that in WordPress is so difficult!)

I’ve migrated most of SavingNinja already, I just have to do some more cleaning up and get my URLs ready to be redirected to the new structure. I’m hoping that this will be the last blog post that I make on WordPress.

From what I’ve seen so far I am SO impressed with Hugo. Building SavingNinja with it is like a dream, it just works! I initially thought that static sites couldn’t have comments, but there is a way to enable them using platforms like Disqus. You can even enable Google analytics and email marketing, so there really is no downside to leaving WordPress!

What does this mean to you? Not much. You’ll still get email updates and the URL will remain the same, you’ll just be welcomed to a different-looking site next time you visit. It may start off looking a little basic, but I plan on iteratively making improvements to the aesthetic over time.

I’ll post on Twitter when the switch is complete!