FIRE stands for Financial Independence / Retire Early, but it isn’t just a concept, it’s a way of living. A movement that shares its routes with anti-consumerism and minimalism. A community which thrives on helping one another and is enthralled with passionate and subversive entrepreneurs whose single goal is to maximise their happiness.

The movement is full of intellectuals that understand happiness isn’t achieved by consuming products.

They’ve discovered that to be happy, money is better spent on increasing time with loved ones instead of buying the ‘next best thing’ that advertisers throw their way.

Let’s dig a little deeper.

Would you Deprive Yourself for Future Happiness?

The concept of FIRE is to reduce your spending and increase your earnings, to a point that will allow you to have enough money to live your life without needing to work (Financial Independence). You would then have the means to retire at a much younger age (Retire Early).

Compound interest would allow an individual who saves 75% of his income to become financially independent in a little over 5 years (more on the Maths later). But in order to save this much, you have to subjugate yourself to what a lot of people would call ‘deprivation.’

Investing most of your income calls for cutting out most of your big expenses. You better get acquainted with driving banged up old cars again, going on cheap camping holidays, and shopping in the supermarket own-brand isle.

The way compounding works is by investing as early as possible. It pays to save a lot now and not have to save anything later, rather than to save in a mediocre way throughout your life. Would you live like a student for 5 years in order to live a financially prosperous life for the rest of your days?

Most people would say yes. I always preach that you should be eating beans until you have 100k invested . If you’re still in your 20’s and you haven’t yet got kids, this is even more important. Right now it is easy for you to save most of your salary, you should be doubling down and investing as much as you can. Doing so would allow you a life of luxury when you do start a family.

Most people who find this movement later in life have one regret: They wish they’d started younger. If they did, a lot of these people would be retired already!

What if it Wasn’t Deprivation?

What most people don’t realise about the FIRE movement is that it’s underlying core message isn’t about saving or earning more (although they are the main tools), it’s about the quest for happiness.

It’s about breaking out of the norm and realising that happiness doesn’t revolve around leaving your kids and wife for over 40 hours a week.

Realising that everlasting joy isn’t the same as the instant (and short-lived) endorphin rush that you get from buying something new and shiny.

Realising that living your life this way will never make you content.

Peel back the onion even more and you’ll see that behind the FIRE movements message of don’t spend money on things that don’t matter lays a deeper meaning. One that tells the observer “spending money doesn’t make you happy.”

Buying things can bring unhappiness. There’s a reason that the Monks of Tibet hold little personal possessions on their road to enlightenment. And, there’s a reason that when you go on a camping holiday and you’re forced to live minimally, and interact with your fellow human beings in a natural way, you’re happier.

While technology has brought about a whole lot of good in the world, most of the population are consumed by it. We are fooled into thinking that we need the latest and greatest to be happy - capitalism’s greatest trick - when in actual fact, happiness lays in the opposite direction.

Think of the FIRE movement like this: You’re spending less to be happier now. Investing the rest to become financially independent is just the side-effect, which will, in turn, bring even more happiness.

The Math

The maths is simple, all you need to focus on is your savings rate. The higher your percentage, the lower your working life.

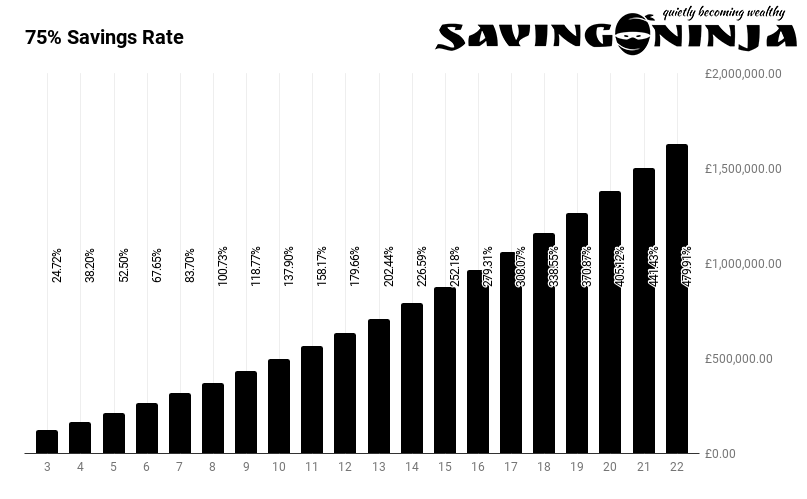

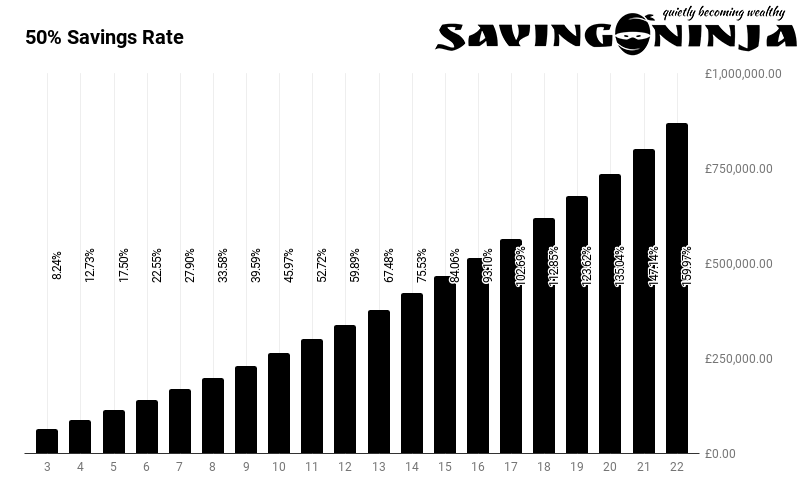

% represents total expenses covered by ROI

With a 75% savings rate, based off a conservative 6% ROI (Return on Investment) and a 4% safe withdrawal rate, you’re looking at having enough for your ROI to cover your expenses just before you hit the 7 years worked mark. Pretty impressive.

With a 50% savings rate your working life is stretched to a little before 17 years - which is still pretty bloody awesome.

If you’re able to save 50% of your income since the age of 22, you’ll be able to quit work at the age of 39.

The reason you’re able to save up this much after a relatively short amount of time is because of a thing called compound interest.

If you invest £10,000 and earn an interest of 6%, that means that you’ll have a pot size of £10,600 at the end of the year. The year after, you’ll not only earn another £600 from the initial £10,000, you’ll also earn £24 from the extra £400 interest you earned on the previous year.

This is what compound interest is - interest earning interest, then that interest earning more interest and so on. That £24 may not seem like much, but over the years it compounds and multiplies into sums that are unimaginable.

If you leave that £10k invested and don’t touch it for 10 years, it would have almost doubled to £18k, another 10 years and it would have more than tripled to £32k.

But if you want to understand the true power of compound interest all you need to do is see what happens to that £10k after 50 years:

Compound interest alone would have turned it into £184,201.

This is with modest interest, we’re not trying to beat the market here. Everything is being put into a low cost index fund, these have historically returned more than 6% interest for the past 50 years. They also require zero effort on your part. All you need to do is open an investment account and this insane, magical compounding effect can be yours.

Easy, right?

Saving is Always Good

The power of compound interest rewards those who invest as early as possible which is why I always say that you should be eating beans until you have 100k invested . This should be your #1 focus!

You can even apply these principles if you’re not planning on retiring early.

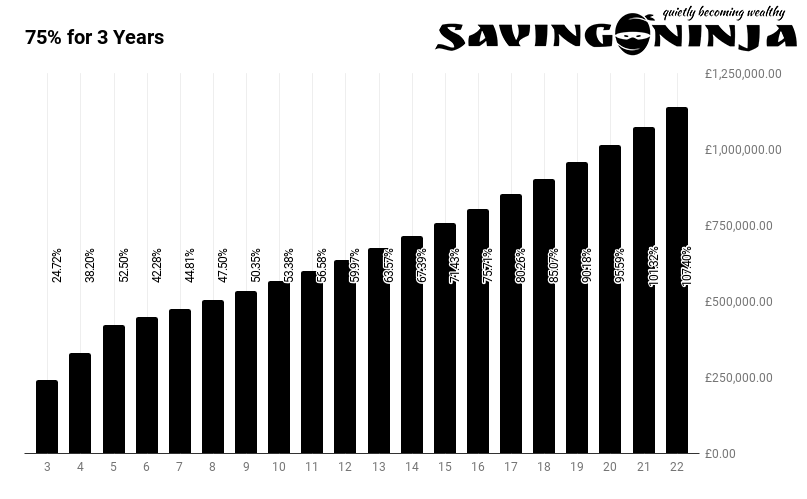

For example, check out this graph:

If you tried hard to save 75% of your income for the first 3 years of your career (trust me it will be easier now than when you have kids later), then you saved absolutely nothing at all ever again. Due to compounding, you’d have enough to retire after 21 years.

Think about that for a second, save 75% of your income from age 22 to 25. Save nothing ever again, you’ll then be able to retire at 43. Worth the ‘sacrifice?’ Definitely!

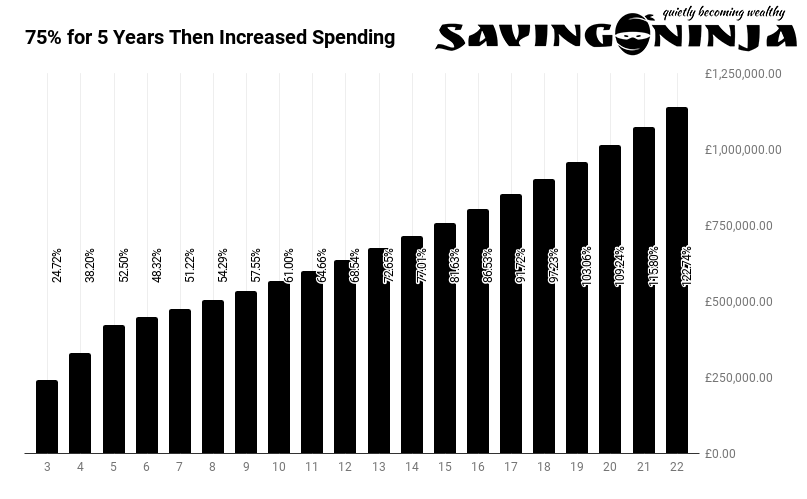

Another scenario is this:

Save 75% of your salary for 5 years, then save nothing ever again **and **increase your spending by 50% (you might want to increase your lifestyle), you’ll still be able to retire (with your new higher expenses) in only 18 years.

So, work your butt off from 22 to 27 and save 75% of your income. Then start a family and increase your spending by 50%, save nothing until you’re 40, then retire. Sounds pretty awesome, right?

That 100k you saved in your 20’s? Yep, it’s now worth £1million in your 60’s. Give your hard working 20-year-old self a pat on the back, you’ve set yourself and your family up for life.

Saving is always good.

Don’t leave your future self wallowing in self-pity for not taking advantage of compound interest as early as possible. The years will either work with you or against you.

Putting this Knowledge into Practice

To get started it’s really easy. Just open a Vanguard ISA or Halifax Share Dealing account and invest in a Vanguard Lifestrategy fund. These are the ultimate low cost, hands-off funds for people like us, just trying to get that 6%.

It’s better to start investing now and then decide on your approach later. Switching to a different fund later on is much better than investing nothing at all, remember - you don’t want to miss that compound interest gravy train!

Here is an awesome Monevator article that explains the different LifeStrategy funds you can choose from, use this as a guide for now as I haven’t yet written my own fund choice post.

This is a Saving Ninja pillar post - it will be periodically updated as new content is written on the subject.