I’m ending this year with both a high and a low. The high being that my financial independence target of £300k was reached in December 2021 , and the low is that during Christmas both myself and my wife caught COVID.

We’ve lasted for over a year in a mask-free state in Sweden, commuting to work, going out for drinks, and we never caught the virus. We go back to the UK for Christmas and then when we arrive back in Sweden we’re positive; what a plague-ridden country the UK has become! :]

We’re feeling very fluey now and have horrible coughs, but we’re not too bad. But it’s a horrible start to the new year. As cases rise, I’m wondering how many of you are experiencing a similar start after going home for Christmas?

On to the review! 2021 was my first full year living in Sweden, how did it go?

2021 has been a hallmark year, whilst at the same time feeling insignificant.

There was a new home purchase in April, followed by my biggest financial growth year to date when I thought that I wouldn’t be able to invest much.

I achieved my ambition of becoming an Engineering Manager, I now don’t do any coding in my day job.

Oh, and I hit my FIRE net worth number of £300k.

A lot has happened, all good things. But just like my feelings when I finally expatriated from the UK, these goals being hit have left me feeling glum. I perhaps invest too much thought and energy into doggedly pursuing these goals, that I believe there will be some kind of euphoria when I hit them; when I don’t get that euphoria, hitting them seems to have an adverse effect.

I was dead set on becoming an Engineering Manager, as soon as I got it I started thinking, “Shit, what now?”

I know this is how future planning works. I know I need to start living more in the present; that I won’t gain happiness by hitting some kind of arbitrary goal. Maybe it’s an addiction?

I just hope that when I finally do get to my ‘final destination’, when I finally do think… ‘Yeah, this is where I imagined that my family will settle and start living our lives.’ That I can start living in the present. I hope that I won’t instead spiral into a depression until I set more goals…

2021 Financial Review

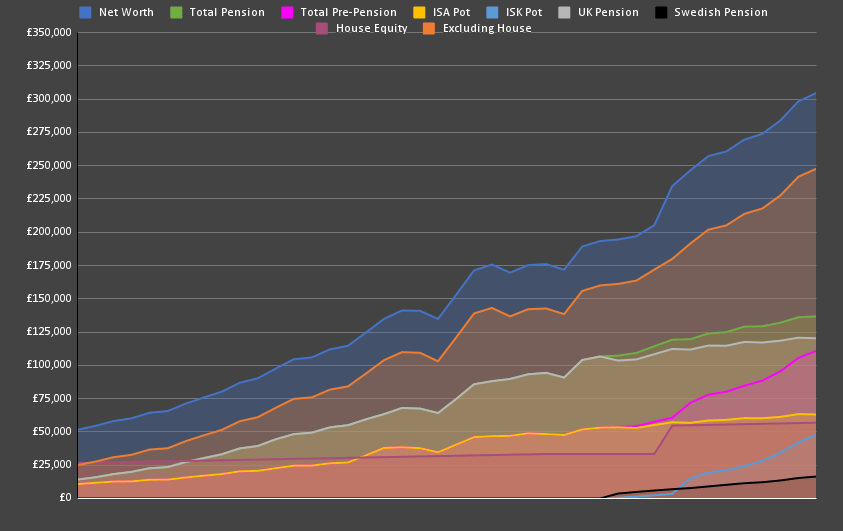

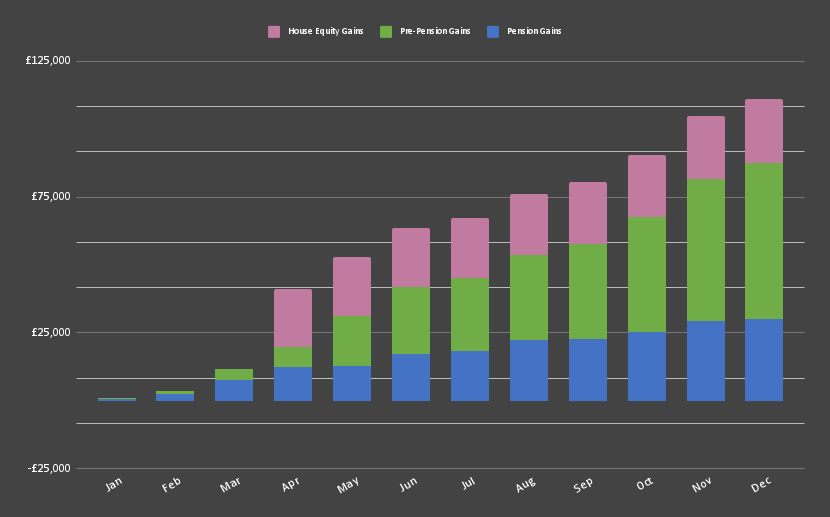

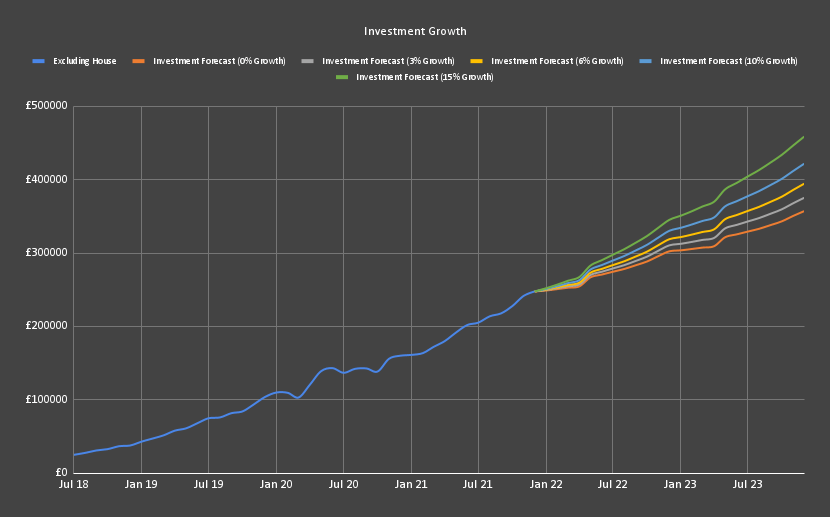

£304,579 Networth (+£111,196)

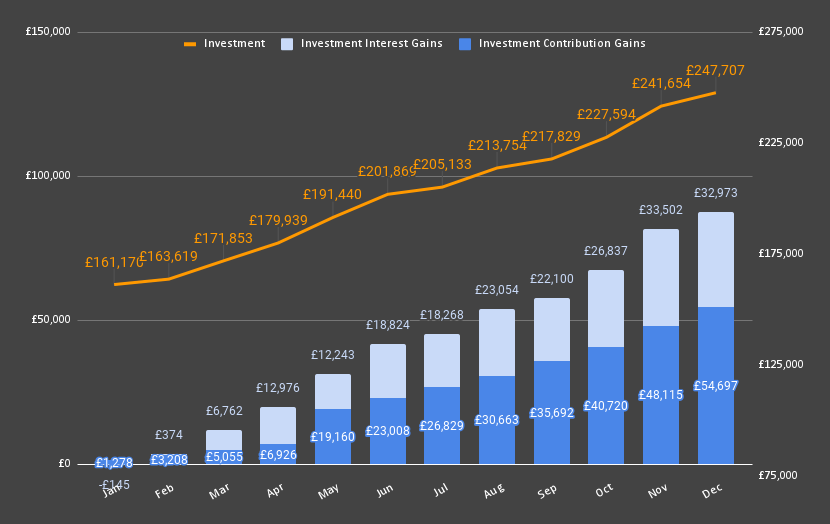

£247,707 Excluding House (+£87,686)

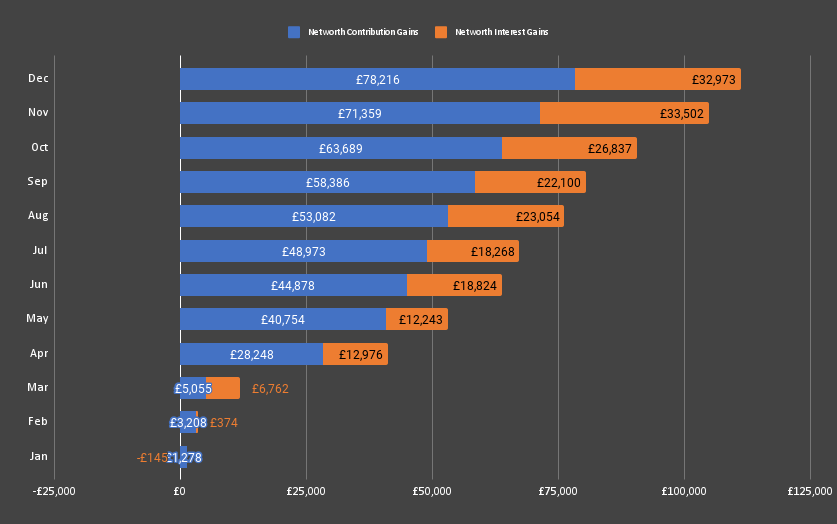

£78,207 Contributed

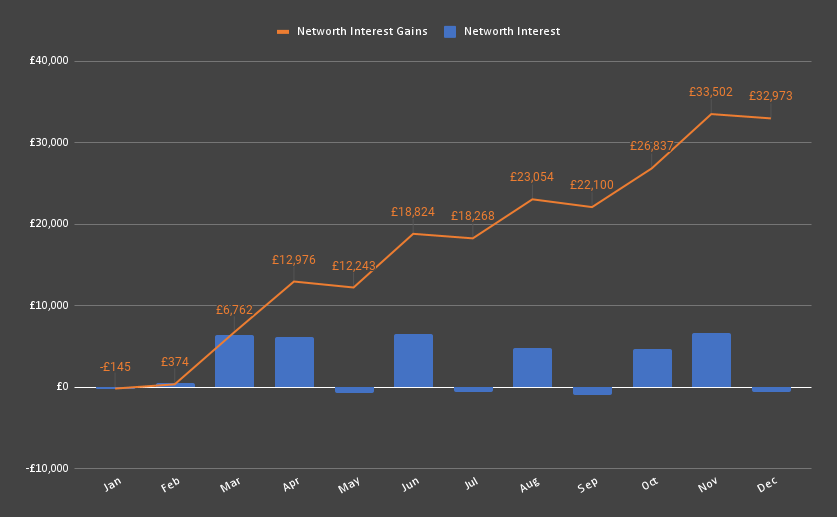

£32,973 Interest Earned

£136,762 Pension (+£30,110)

£10,944 Contributed

£19,135 Interest Earned

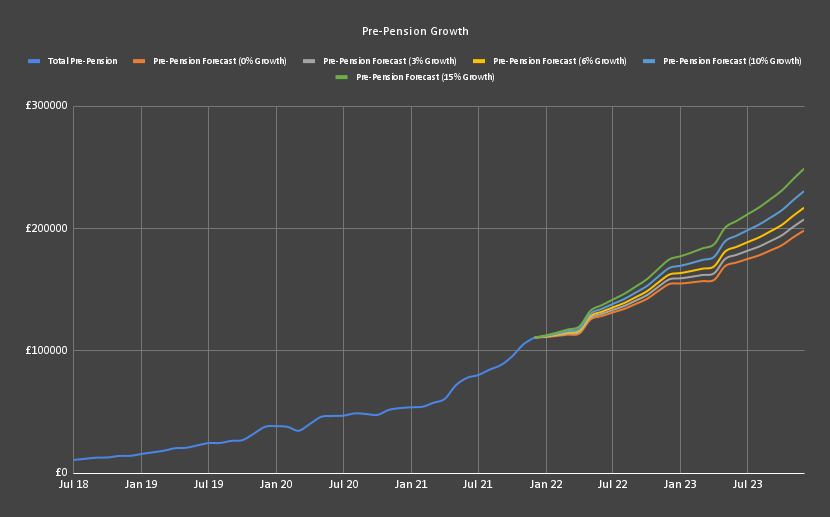

£110,920 Pre-Pension (+£57,567)

£43,738 Contributed

£9,867 Interest Earned

£56,871 House Equity (+£23,509)

£23,509 Contributed

£33,362 House Equity (+£2,331)

£2,331 Contributed

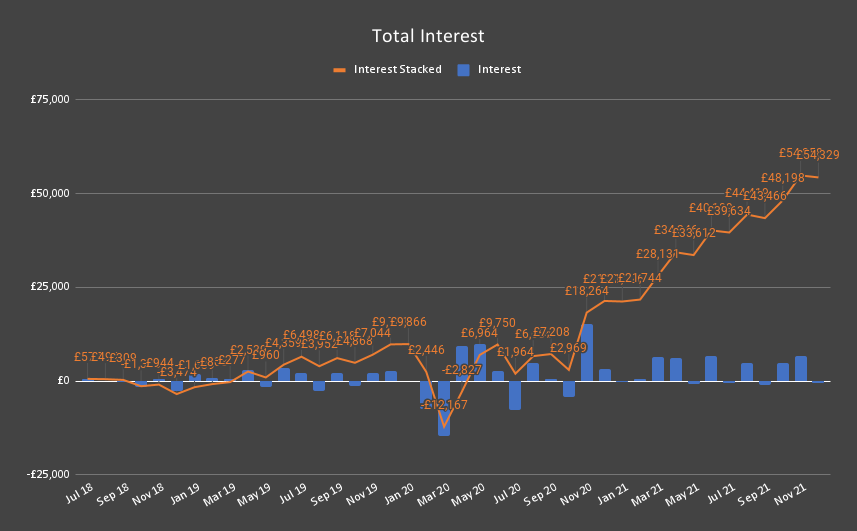

There may be slight inconsistencies across the charts and figures. This occurs due to the Super Spreadsheet dynamically looking up the exchange rate for my different held currencies (USD, SEK, and GBP) and dynamically updating my net worth.

Subscribe to SavingNinja to get access to all of the same juicy charts for personal use.

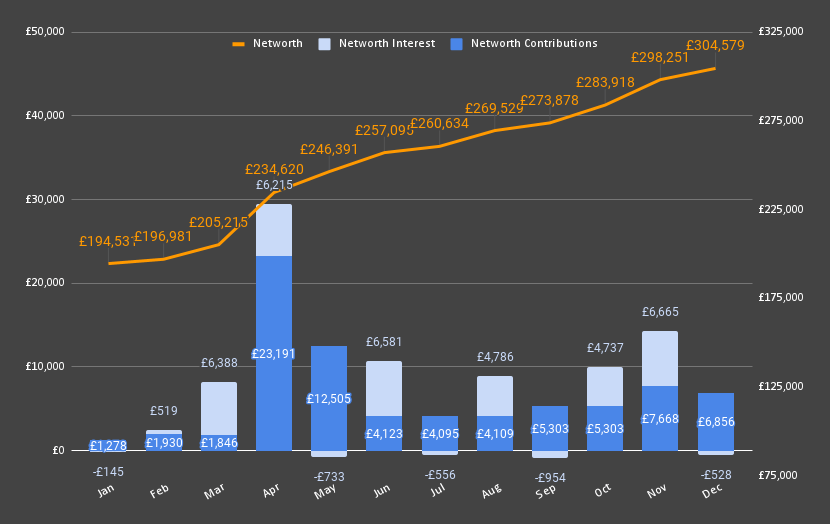

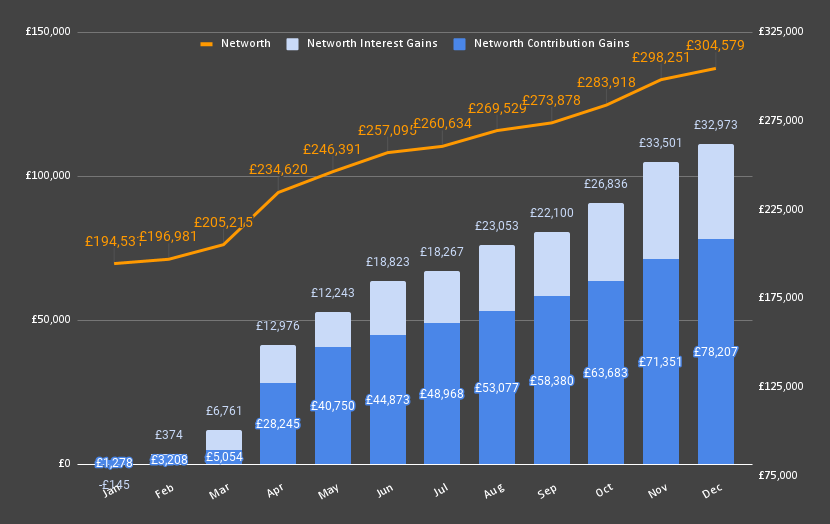

£112k of growth. By far my biggest year of savings ever.

My networth grew past my initial financial independence goal of £300k with my biggest growth area being my pre-pension accounts.

This year saw an additional bump in net worth gain due to buying a new house in Sweden and adding that asset to my tracked portfolio. My house equity total increased by almost double with an additional £23,509 being added. My pre-pension pot gained £57,567 with £43k being contributed into my Swedish ISK and £15k being earned in interest across my English ISA and Swedish ISK.

My pension grew by £30,110, this is much more than I thought it would grow as all I’m gaining is my employers automatic deposit and interest growth, I’ve stopped contributing anything myself into a private pension now. Normally, it should increase less if we didn’t have insane 16% stock market growth. If it continued growing this much, at 16% per annum (which is ridiculous) and my employer continues investing £870 per month, I’d reach the UK lifetime allowance at the age of 41, and it would be worth £23m by the time I retired (whew, compound interest!) This is, of course, very unlikely to happen and I won’t be working for the next 30 years, hopefully…

My networth chart is growing steeper and steeper, although I expect it to level out a little in 2022; I don’t have any more matched betting money ready to deploy like I did for our Swedish house purchase.

I added my Swedish home equity to the savings sheet in April, and deposited some extra cash into my company stock in May. From June onward I began slowly emptying my spare cash until I was back at a 3-month emergency fund.

Interest earned has been staggering this year at around £33k, this has doubled my lifetime interest earned since I began investing in the stock market, it now stands at £54,300.

My forecasts show that by the end of 2022, I should have over £300k of investments, even at 0% growth, and I’ll be approaching £175k pre-pension, liquid investments.

Goals Results

Below are my goals from 2020 Reviewed .

1. Apply to at least 2 management positions (A+)

I definitely achieved this one, I applied to a total of 2 management positions in 2021 and on my second application, in October, I got the job. I even managed to stay in the same team. I did this by doing two things: Getting an Engineering Manager mentor which I met with each week. And starting a portfolio listing all of my leadership initiatives and achievements.

When changing into an EM role from an engineer, the main thing that your hiring manager will be looking for is proof that you really want this and that they should give you the chance with no prior experience. Joining the official mentorship program myself and mentoring an associate engineer helped me gain some 1:1 coaching experience too!

2. Become comfortable at my new company (A+)

I feel way more comfortable at my company than I did at the beginning of 2021. So comfortable that I got the job of Tech Lead and then Engineering Manager within my team. I think most people feel awkward and impostery when they start a new job, especially one that’s so different from previously worked at companies, but it’s just a natural feeling that you overcome with time.

3. Start saving at least 50% of my salary again (A+)

A+! I wasn’t sure how much I was going to be able to save in Sweden, but my savings rate shot up to 75%+ again after realizing that our Swedish Budget was better than our UK budget .

4. Release version 1.0 of my app (D)

I have been working on my app, and it’s got to a pretty good state, but it’s far from being ready to release. A lot of my spare time has been spent writing which has left me with very little time to program. A lot of the initial set up has been completed, now it’s just the UI and some more features to develop, hopefully 2022 will be the year that version 1.0 is ready!

5. Reach £200k invested and £250k net worth (A+)

I blew this one out of the water. When I set this goal my net worth was only £193k and I hadn’t planned on contributing much. This soon changed as we bought our Swedish house. I’d suspect that I won’t be able to contribute as much anymore as I no longer have any matched betting savings to supplement my contributions.

Pondering New Goals

Over the course of 2021, I and my wife have thought a lot about if Sweden is the country we want to settle in forever.

We’ve come to the conclusion that Sweden isn’t our place. As I expanded on in Savings Report #40 , we still want to try living in the USA. If we can’t move there, we’d like to go back to the UK until we can. Sweden’s salaries are low, my subsequent salary in the UK will be more than 30% higher, and the cost of living is lower.

Employers have to pay more than 100% of their staff’s salary again as tax in Sweden, so less of their total employee spend goes to the employee. This is the opposite in the US where my subsequent salary will be 150% higher, as barely any tax is taken off my employer at their level.

Of course, money isn’t the only reason we would like to leave, but it’s a strong one. Another reason is I’d like to start living our FIRE life. Now that I’m working remotely there is no reason not to.

We want to go and live in a rural area and build something. Why not do that right now?

I like my job, I’m not desperate to leave it, even if I were FIRE I’d probably continue doing it. Not living our end-goal dream right now seems silly.

The only blocker is not being in the country we would like to stay in.

Living our post-FIRE life early would mean investing in a larger remote property, and focusing on spending more and digging in our roots. I don’t want to do this in a country where we might leave. We’ll only ever get the cheapest property unless we knew we were going to stay for the long term.

So, my 2022 goals are going to be focused around that, starting to live our post-FIRE life right now. And doing everything I can to move in that direction, which right now is getting to America.

Goals for 2022

1. Move or set up for a move out of Sweden

I know that I don’t want to stay in Sweden indefinitely, it doesn’t make sense financially or for happiness. By the end of 2022 I’d either like to be living outside of Sweden, or have a plan set up for moving out of Sweden.

2. Try to get to the US

I’d like to make a big effort to get to the US in 2022 so we can start living our post-FIRE life right now. This would involve trying to get there whilst maintaining my current position, or applying to US-specific internal positions within my company. If this fails, I’d like to consider applying to another multi-regional company.

3. Master 1 algorithm a week

I’d like to slowly re-build my technical interview skills by mastering 1 algorithm a week. This will be needed if I can’t get to the US within my current company. Having a solid foundation of algorithms is also a really good skill to build for if I ever wanted to try to work at Google (I have a referral from an ex-colleague now!) Real algorithmic understanding takes a lot of time to learn, it’s best to go slowly and be consistent and purposeful with learning this knowledge, like building a muscle.

4. Read nothing but foundational learning books

After reading Naval’s almanack , I’ve decided to put down my fiction books and read nothing but non-fiction for a whole year. I’ll be focusing on foundational learning books for physics, maths, philosophy, economics and history. A post about this is to come!

5. Release version 1.0 of my app

This is a missed goal from 2021 . I’d like to continue to strive toward a version 1.0 release. I may miss the mark again as I’ve got a lot on my plate with work, a 6 month book to co-author, and all of these goals; but if I make a considerable dent I’ll be happy.

6. Reach £300k invested assets (excluding property)

As my focus turns more to the non-monetary, it’s still nice to set one financial goal. Reaching £300k in the stock market seems like a nice target (currently I have £247k excluding property).

Alright, bring on 2022!